The oil and gold asset risks are analyzed from two perspectives, i.e. asset portfolio extreme returns and their volatilitiesvia daily oil and gold price data from January 2, 2006 to April 14, 2017.

First, two time series regression models are employed with residuals modelled from 30 GARCH-D processes,

rg,t=

μg1+

δtro,t+

εg,t where

δt=

δ01+

δ11·I(

ro,t<

qo,t0.10)+

δ21·I(

ro,t<

qo,t0.05)+

δ31·I(

ro,t<

qo,t0.01), and

rg,t=

μg2+

δtro,t+

εg,t where

δt=

δ02+

δ12·I(

t1 ≤

t ≤

t2)+

δ22·I(

t3 ≤

t ≤

t4), to verify whether the gold is the hedge or safe haven for the oil. The empirical results,

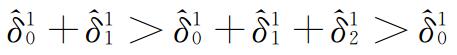

and

+

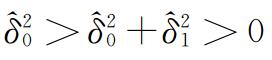

for the first regression, and

and

for the second regression, show that the gold is neither the hedge nor the safe haven for the oil from the perspectives of portfolio returns.

Second, the DCC-GARCH model is employed to explore the co-movements between oil and gold, and the empirical results show that there exist the dynamic characteristics in the co-movements between oil and gold, but the co-movements may be weaker in the extreme crisis period. Then, the variance-minimum portfolio is constructed via solving the programming problem,

P1:min

ωt Var(

rp,t|

Ft-1),

s.t.0 ≤

ωt ≤ 1, based on the DCC-GARCH model, the portfolio return series

rp,t=

ωt* ro,t+(1-

ωt*)

rg,t are obtained, and then the conditional distribution of the returns

rp,t is modeled to measure the risks of unit asset portfolio. From the perspective of portfolio volatilities, the empirical results show that the variance-minimum portfolio of oil and gold can reduce the unit asset risk exposures, especially during the extreme oil market period, i.e. the 2008 global financial crisis and the crash in oil price after 2014.

Last, this paper is conducive to understanding the safe haven nature of gold assets, and also offers the investors some practical significances to avoid oil market risks viaoil and gold portfolio strategy.